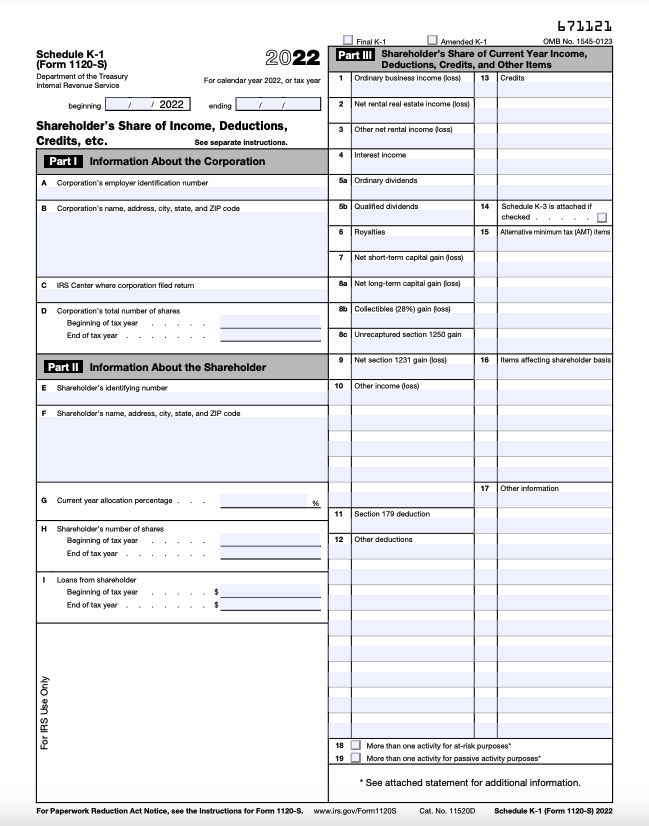

2024 Schedule K-1 Instructions Meaning – Partnerships have general partners and limited partners. Both types of partners report losses on Schedule K-1. Limited partners are not financially responsible for losses in the company . If you’re the beneficiary of an estate or trust, it’s important to understand what to do with this form if you receive one and what it can mean for your tax filing. Schedule K-1 (Form 1041 .

2024 Schedule K-1 Instructions Meaning

Source : www.bench.coHow Do I Fill Out a Schedule K 1? | Gusto

Source : gusto.com2023 Partner’s Instructions for Schedule K 1 (Form 1065)

Source : www.irs.govSchedule K 1 Tax Form for Partnerships: What to Know to File

Source : www.bench.co2023 Instructions for Form 1041 and Schedules A, B, G, J, and K 1

Source : www.irs.govSchedule K 1 Tax Form for Partnerships: What to Know to File

Source : www.bench.coWhat is a Schedule K 1 Tax Form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.comK 1 Visa Timeline, Fees, and Requirements

Source : www.boundless.comHow Do I Fill Out a Schedule K 1? | Gusto

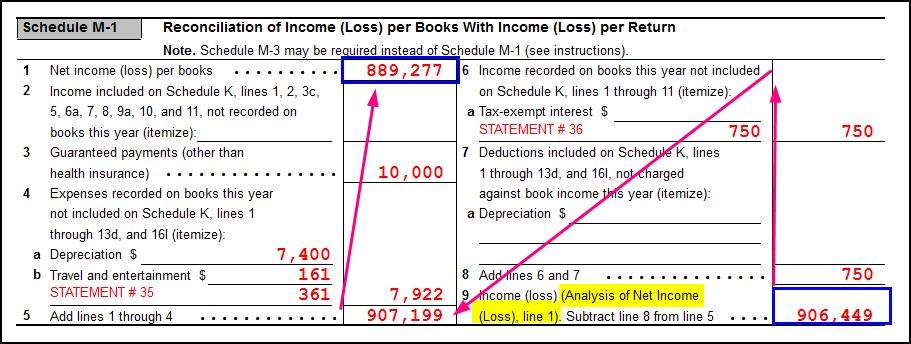

Source : gusto.com1065 Calculating Book Income, Schedules M 1 and M 3 (K1, M1, M3)

Source : drakesoftware.com2024 Schedule K-1 Instructions Meaning Schedule K 1 Tax Form for Partnerships: What to Know to File: Every partnership, S corporation and applicable LLC must submit Schedule K-1, “Partner’s or Shareholder’s Share of Income, Deductions, Credits, Etc.” to the business’s owners for the . If you run your business as a pass-through entity like a partnership (meaning your partnership Pass-through entities use a tax form called Schedule K-1 to report a partner’s or shareholder .

]]>