2024 Form 1040 Schedule Sejda – You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . Recent changes to Form 1040 mean different filing options for seniors. Get the facts about eligibility and reporting for this new version of Form 1040-SR. Recent changes to Form 1040 mean .

2024 Form 1040 Schedule Sejda

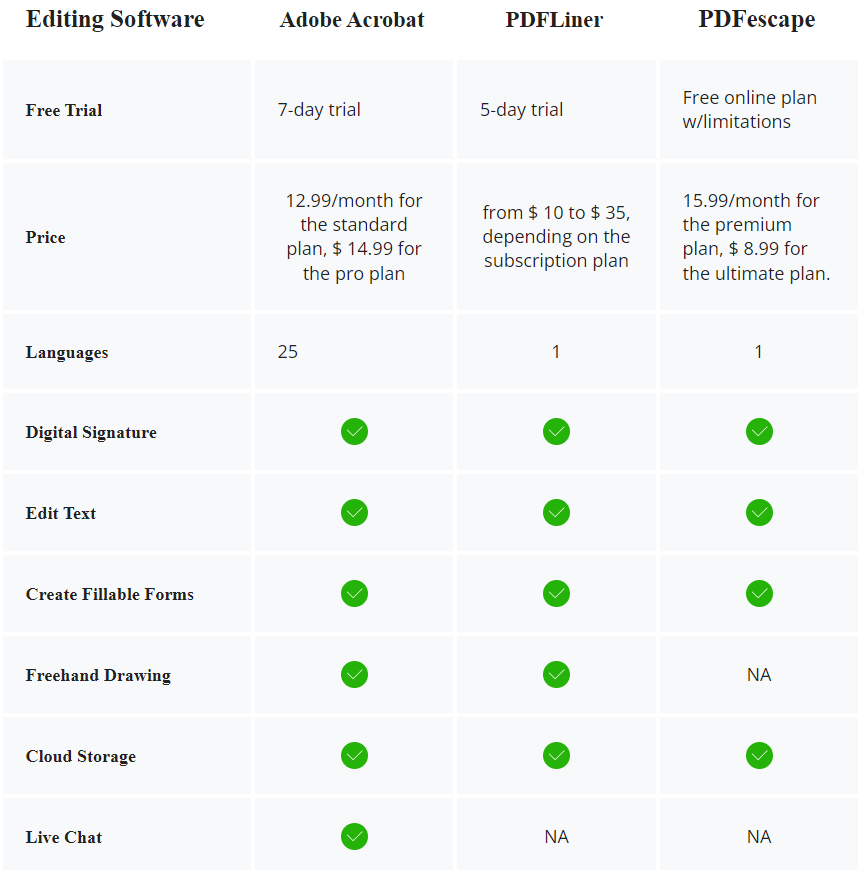

Source : blog.pdfliner.comTop 5 Best PDF Editors for Students – pdfFiller Blog

Source : blog.pdffiller.comSejda PDF Desktop vs Bluebeam: What Is More Convenient?

Source : blog.pdfliner.comYouthWorks 2021: MW507 YouTube

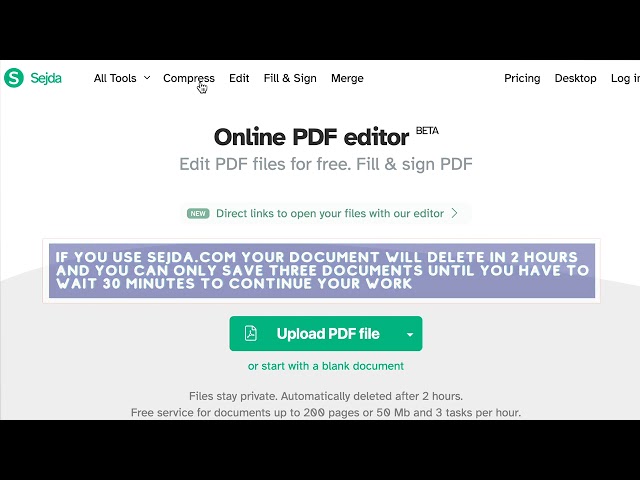

Source : www.youtube.comSejda Free vs Premium Comparison & Similar Tools Pricing

Source : blog.pdfliner.comTop 5 PDF Filler Free Online You Must Try in 2024 | UPDF

Source : updf.comHow Safe Is Sejda: Top Safety Features Reviewed

Source : blog.pdfliner.comYouthWorks 2021: MW507 YouTube

Source : www.youtube.comSejda Free vs Premium Comparison & Similar Tools Pricing

Source : blog.pdfliner.comYouthWorks 2021: MW507 YouTube

Source : www.youtube.com2024 Form 1040 Schedule Sejda Sejda Free vs Premium Comparison & Similar Tools Pricing: Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 . Travel expenses can be deducted on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship), or Schedule F (Form 1040), Profit or Loss From Farming, if you’re self-employed or a .

]]>