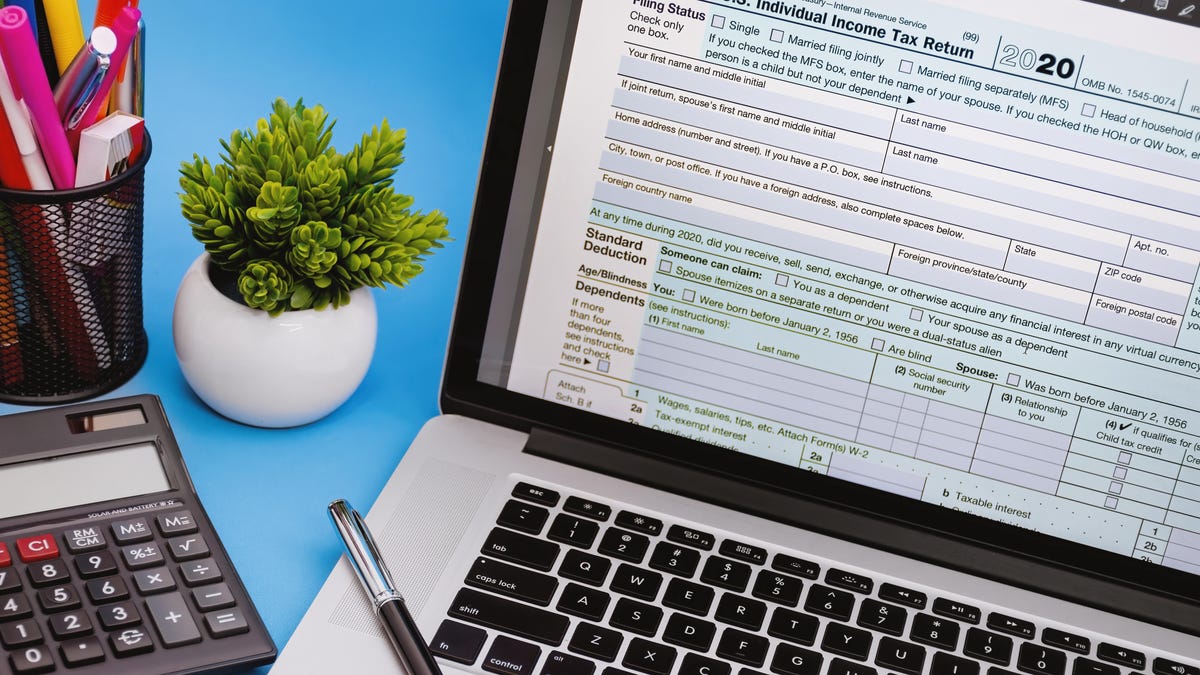

2024 1040 Schedule Calculator – But it’s nice to understand how the math behind the calculator works. You can create an amortization schedule for an adjustable-rate mortgage (ARM), but it involves guesswork. If you have a 5/1 . To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are .

2024 1040 Schedule Calculator

Source : thecollegeinvestor.comA Tax Prep Guide to Reduce Your Tax Season Stress

Source : www.arthurstatebank.comIRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.orgUs Budget: Over 30,783 Royalty Free Licensable Stock Photos

Source : www.shutterstock.comIRS Mileage Rates 2024: What Drivers Need to Know

Source : www.everlance.comIRS waiving $1 billion in penalty taxes, will kick off 2024 tax

Source : www.foxbusiness.comIRS Introduces Updated Tax Brackets and Other Adjustments for Tax

Source : www.canoncapital.comUS IRS 1040 form or US Individual income tax Concept, accountant

Source : www.vecteezy.comYear End Tax Planning 2023 2024 | Crowe BGK

Source : www.crowe.comTax Season 2024: How to Create an Online IRS Account CNET

Source : www.cnet.com2024 1040 Schedule Calculator When To Expect My Tax Refund? IRS Tax Refund Calendar 2024: She has been instrumental in tax product reviews and online tax calculators wages on line 1 of Form 1040, while self-employed persons typically would report it on Schedule C, “Profit or . You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. .

]]>

.png)